Commentary: When digital banking fails, a tucked-away S$10 wins the day

Frustration ran high after DBS and Citi online banking and payment services went offline last weekend. Cherie Tseng, Chief Operating Officer of Secur Solutions Group, looks at how bank users can be better prepared for such disruptions.

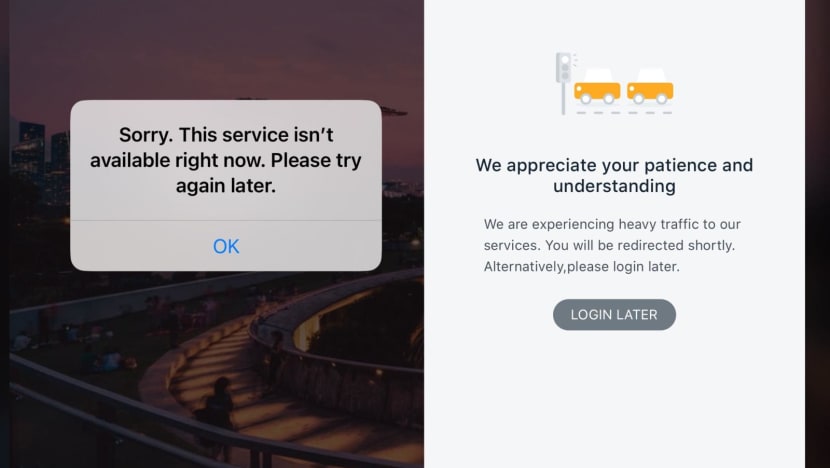

Screenshots showing the DBS Ibanking service page and Paylah service being down on Oct 14, 2023.

SINGAPORE: I was travelling with my husband in Seoul for work last weekend when my teenage son pinged to let me know he urgently needed to purchase some items for a school project. The shopping list was a little more than his allowance would cater for, so we said we’d send some funds over.

Easy peasy open-app-and-find-the-payee, right? Wrong. And that was how we found out about the DBS and Citi banking services outage on Saturday (Oct 14).

The hours-long online banking and payment services outage left customers across the island stranded - and outraged. Unable to make payment via PayNow, PayLah!, NETS as well as credit cards, many found themselves stuck at petrol kiosks and car parks. Some had to abandon their shopping carts at supermarkets. DBS automated teller machines (ATM) at some locations were also affected.

This is the not first time this year DBS has faced disruptions to their online banking and payment services - it’s the third.

On Mar 29, DBS digital services were down for most of the day, with the disruption caused by "inherent software bugs". On May 5, a human error in coding the programme that was used for system maintenance affected access to DBS online and ATM services for more than six hours.

The most recent outage was caused by a technical issue with the cooling system at a data centre used by both DBS and Citi.

If history is anything to go by, the response to the latest disruption will take a three-track path: Customers will complain about the inconvenience and decry the feasibility of Singapore going cashless; the banks may be made to review their operational processes and system resiliency; and the authorities may slap the infringing parties with additional requirements and demand they do better.

All of that is absolutely fair and understandable.

Undoubtedly, the banks - all of them, not just the two involved - will learn from this. Hopefully, they will build in better public relations and customer recovery, double down on redundancy systems and improve their scenario planning.

It is impossible to say when another outage will happen again. After all, no technology system is infallible.

MISSING LINK TO A BETTER CASHLESS SOCIETY?

From a larger societal roadmap to being cashless, this will be chalked up as a huge learning experience. But I wonder if the missing link to making a cashless system work better is if society - you and I - see ourselves as part of the whole digitalisation process, instead of mere consumers.

Singapore has come a long way in its cashless journey. While the popularity of digital banking and cashless transactions only really took off in the last few years, the national campaign to minimise cash transactions started way back in 1985.

“The widespread use of electronic fund transfer systems and the acceptance of cashless transactions would usher in a new era of comfort and convenience in banking and cash management services,” said then Acting Minister for Labour Lee Yock Suan in a speech to launch the campaign on Mar 14, 1985. “We can look forward to the day when we could do our shopping, pay our bills, check our bank accounts and transfer funds from one account to another all in the comfort of our homes.”

The initial take-up wasn’t exactly speedy. In a study commissioned by the Monetary Authority of Singapore (MAS), KPMG found that 60 per cent of consumer payments were still being made in cash in 2015.

But by 2023, Singapore’s adoption rate of cashless payments was the highest in Southeast Asia at 97 per cent, based on payment methods at Singapore retail points-of-sale in 2022, according to a survey by German statistics company Statista.

NO WALLET, JUST A PHONE

We are far from being newcomers to digital banking, but it’s only been in recent year that there’s been a rapid surge in people adopting cashless payments for their day-to-day transactions. I know of some people who do not even carry wallets around anymore - relying solely on their phone for payments.

And while the backend infrastructure has been fortified to present some measure of robustness, we are still in our first decade where the human interest in going cashless is finally matching the plan.

As with most things, is easy to update the system. It is harder to change the human.

And, even if we want to hold banks who falter accountable, we must be careful to separate the system from the players in the system.

Last weekend, the backend system of two banks went down. Was it inconvenient? Yes, immensely so. Was the impact fairly large? Yes, undoubtedly.

But were there alternative methods to engage the banks? Yes, over-the-counter services were still available, as were ATMs, even if some were impacted. Were there other avenues to pay for things? Yes, seeing as we are home to other local and international banks and have in our payment ecosystem the likes of GrabPay, Google Pay, Alipay, and even the stored value EZ-Link and NETS Prepaid cards.

So, while the two banks had, albeit massive, backend issues, the larger “cashless” system in Singapore remained intact. It was the human in the mix that was inadequately equipped and unprepared for the situation, even after the experiences of the previous outages.

CASH STASH JUST IN CASE

While venturing out without their wallet is de rigueur for many, it is not uncommon for people to stash a S$10 bill in the back of their phone for those just-in-case moments.

Likewise, many motorists carry at least two cashcards in their car, just in case one runs out of money and a top-up station cannot be found. And even a decade ago, Singaporeans already owned multiple credit cards – although, it might be a good idea to make sure they are from different banks.

But it seems the same people who’d tell a primary school child to keep money in a hidden part of their school bag for days they forget their wallet don’t often practise the same proverbial rainy-day preparations themselves.

While it is true, as touted by other commentators, that banks must focus on fortifying reliability to retain confidence as they digitalise, as users of those very services the banks are offering, we must realise that we, too, play a part in making the system work for us.

We shouldn’t practise fire drills only when the building is on fire.

Cherie Tseng is Chief Operations Officer of Secur Solutions Group and editor with The Birthday Collective.